Table of Contents

1. Introduction

The book “Rich Dad’s Cashflow Quadrant: Rich Dad’s Guide to Financial Freedom” by Robert T. Kiyosaki, aims to provide financial literacy and guidance to individuals seeking financial freedom. The author focuses on the four types of people in the world, namely employees, self-employed, business owners, and investors, and their respective cash-flow quadrants.

Robert T. Kiyosaki is an American businessman, investor, and author. He is best known for his book “Rich Dad Poor Dad,” which has sold millions of copies worldwide. Kiyosaki is a graduate of the United States Merchant Marine Academy and has served in the U.S. Marine Corps.

2. About this book

The book is divided into ten chapters that cover various aspects of the cash flow quadrant, including the benefits and drawbacks of each quadrant, the importance of financial education, and how to transition from one quadrant to another.

The cash flow quadrant is a concept introduced by Robert Kiyosaki in his book “Rich Dad Poor Dad”. The quadrant is a tool that helps people understand the different ways to earn income and the advantages and disadvantages of each.

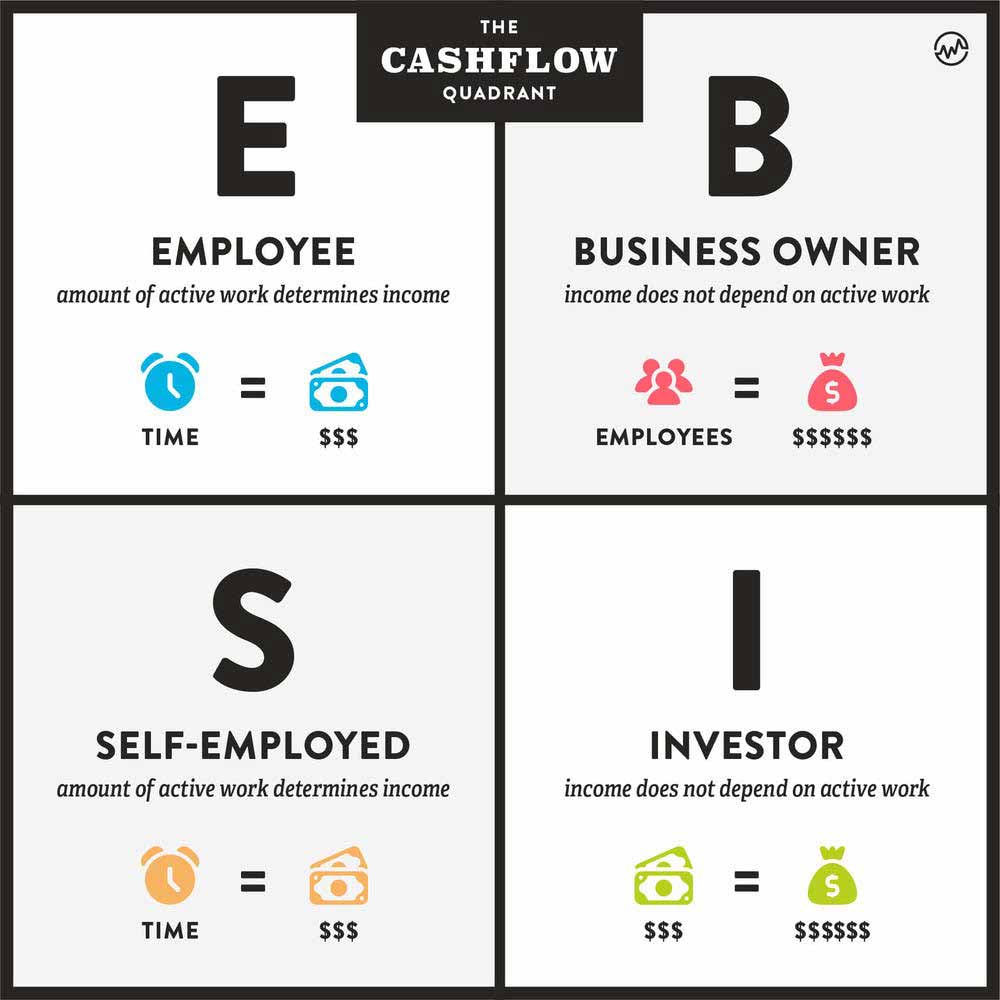

The quadrant is divided into four sections:

- E – Employee

- S – Self-Employed

- B – Business Owner

- I – Investor

- Employees: (E) are individuals who work for someone else and receive a salary or wage in exchange for their time and effort. They have a steady income but are often limited in their ability to earn more.

- Self-employed: (S) individuals are those who work for themselves, such as freelancers, consultants, or small business owners. They have more control over their work but are also responsible for everything, including finding clients, managing finances, and delivering services.

- Business owners: (B) are individuals who have a system in place that generates income without requiring their active involvement. They hire employees to operate the system and manage the business. They have the potential for unlimited income and can create passive income streams.

- Investors: (I) are individuals who use their money to invest in assets that generate income, such as stocks, real estate, or businesses. They have the potential for high returns on investment and can create passive income streams.

Each quadrant has its advantages and disadvantages. Employees and self-employed individuals have limited potential for income growth, while business owners and investors have the potential for unlimited income. However, business owners and investors also have more responsibility and risk.

Understanding the cash flow quadrant is essential for achieving financial freedom. By transitioning from the E and S quadrants to the B and I quadrants, individuals can create passive income streams and achieve financial independence. The key to success in the B and I quadrants is to acquire financial education, develop the right mindset, and take calculated risks.

The key takeaways from the book are as follows:

- Understanding the cash flow quadrant is essential for achieving financial freedom.

- The E and S quadrants are limiting and trap people in a cycle of work, while the B and I quadrants provide freedom and passive income.

- Financial education is crucial for success in the B and I quadrants.

- It is possible to transition from the E and S quadrants to the B and I quadrants with the right mindset and knowledge.

The main argument presented in the book is that financial freedom is achievable through the B and I quadrants, which provide passive income and freedom, unlike the E and S quadrants, which are limiting and require active work.

3. Positives about this book

- The book provides a clear and concise explanation of the cash flow quadrant and its importance in achieving financial freedom.

- The author provides practical advice on how to transition from the E and S quadrants to the B and I quadrants.

- The book emphasizes the importance of financial education, which is often overlooked but crucial for success in the B and I quadrants.

4. Missing in this Cashflow Quadrant

- The book focuses primarily on the U.S. market and may not apply to other countries.

- The author does not provide a detailed plan or strategy for transitioning from the E and S quadrants to the B and I quadrants.

5. Other recommendation

- “The Millionaire Mind” by Thomas J. Stanley provides insights into the mindset and habits of successful millionaires.

- “The 4-Hour Work Week” by Timothy Ferriss provides a step-by-step plan for achieving passive income and freedom.

6. Reception or critical response to book

The book has received mixed reviews. Some readers praise the practical advice and insights provided in the book, while others criticize the author’s writing style and the lack of a detailed plan for transitioning to the B and I quadrants.

7. Who should read this?

This book is suitable for individuals who want to achieve financial freedom and understand the importance of the cash flow quadrant. It is particularly useful for those in the E and S quadrants who want to transition to the B and I quadrants.

Other Books You May Enjoy

Book Review: The Millionaire Fastlane by M. J. DeMarco

Book Review: The Richest Man in Babylon by George Samuel Clason.

2 Comments

Your point of view caught my eye and was very interesting. Thanks. I have a question for you. https://accounts.binance.com/fr/register-person?ref=GJY4VW8W

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me? https://accounts.binance.com/sl/register?ref=OMM3XK51